|

Getting your Trinity Audio player ready…

|

By Zimbabwe Coalition on Debt and Development (ZIMCODD)

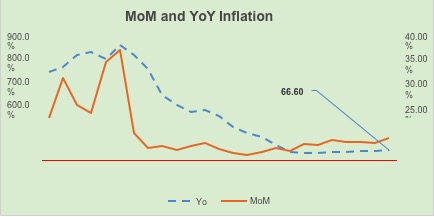

In the week under review, Zimbabwe National Statistics Agency (ZimStat) released February 2022 inflation statistics which showed that on a year-on-year basis (Feb 2021-Feb 2022), price inflation increased by 66.1% compared to an increase of 60.6% realized in the preceding month (Jan 2021-Jan 2022). This is the highest increase in annual terms since June 2021 when ZimStat recorded an inflation level of 106.64%. From a month-on-month (MoM) perspective, that is, from Jan 2022 to Feb 2022, prices mounted by 1.7 percentage points on 5.3% that was realized between Dec 2021-Jan 2022 to 7%. This February MoM inflation rate of 7% is the biggest monthly outturn in 18 months, that is, since August 2020 when the monthly outturn came in at 8.44%.

In the latest 2022 Monetary Policy released early February 2022, the monetary authority (RBZ) is expecting MoM inflation to be reduced in the first quarter (Jan-Mar) to below 4% and to average below 3% in the second half of the year (Jan-June). Below is an extract from the Monetary Policy Statement (Page 64):

“More specifically, the envisaged sustained tighten monetary policy stance will go a long way in anchoring price spectrums in the economy. As a result, month-on-month inflation is expected to be reduced to below 4% in the first quarter of the year and to average below 3% in the second half of 2022. This path is expected to reduce the country’s annual inflation rate to a range of 25-35% by end of December 2022

….”

Going by RBZ’s template, price inflation should average 4% in Q1:22 while the reality shows that in the first 2 months of Q1:22, price inflation has averaged 6.15%. Then, looking at the current exchange rate developments, it is clear that inflation pressures remain elevated in the outlook thus making RBZ’s projections over-ambitious. The Bank continues to fail to meet its projections yearly since 2019 because its views are detached from reality.

How can the Bank expect inflation to moderate in the near term when it is not addressing the chief driver of prices since 2019? ZIMCODD analysis shows that massive exchange rate deterioration being experienced particularly in the parallel market is destabilizing the economy.

Currently, parallel market premiums are hovering above 80% way above the global benchmark of 20%. The Bank’s auction market is just catering for the formal sector and selected few individuals, yet the informal economy is the largest sector in Zimbabwe constituting over 60% of the economy.

Also, because the economy is now re-dollarizing fast, there is increased households demand for forex, and this is being satisfied in the expensive alternative markets. Businesses are now preferring the greenback over the local currency as evidenced by massive discounts for those buying using forex and punitive prices for those transacting in local currency. Even those companies that are directly accessing forex from RBZ at an overvalued rate are benchmarking their ZWL prices at the parallel market rate. All this shows that the Zimdollar depreciation pressure is here to stay as both businesses and the public are lacking both confidence in ZWL as a store of value and trust in the authorities.

The auction market is benefiting corporates, especially importers at the expense of taxpayers like exporters. In the current RBZ exchange regulations, exporters are obliged to involuntarily cede 40% of their export receipts in exchange for the fragile Zim dollar. There is also room for arbitrage – making riskless profits- for those getting RBZ forex as they can trade it in alternative markets at a lucrative price. In the end, it is the average citizens that are being disproportionately affected as they face exorbitant shelve prices of basic necessities. Most Zimbabweans are earning in local currency and the salaries especially for civil servants are now valueless.

Recently, the government hiked public servants’ salaries by 20%, that is from an average of ZW$30,000 to ZW$36,000. Although a part of this salary is paid in forex, the 2022 tax policy sets out that for tax collection, taxes for ZWL earnings will be converted to US dollars. Even if the government comes up with an exception to this, the hiked salaries still fall short of the Poverty Datum Line (PDL) for an average urban household of 6.

Using conservative ZimStat statistics, February 2022 PDL was estimated at ZWL54,864, a 7.6% jump from ZWL50,976 recorded in the prior month. Ironically, the government is reviewing prices upwards in line with the inflation level (and competing with the private sector is doing so) but continues to keep salaries sticky upwards. For instance, ZUPCO, a parastatal, recently hiked bus fares for all local trips. Pitifully, ZUPCO was granted a monopoly in the local transport sector by the government in 2020 under the guise of fighting the COVID-19 pandemic. The same can be said for ZERA, an energy regulator that has been hiking fuel and gas prices since January 2021.

Therefore, the current level of black-market premiums shows that the government’s exchange rate determination mechanism is inefficient and in need of a complete overhaul. There is a need for transparency in conducting this market and it should meet the forex demand of the whole economy. But be that as it may, the current rate the economy is re-dollarizing since the beginning of 2022; the rate the government is on a US dollar fishing expedition through tax policies; and the northward direction ZWL prices are taking without showing any signs of slowing down, the public demand authorities to fully adopt a re-dollarization policy to stabilize the macroeconomy and reduce poverty & poverty prevalence. Inflation should be addressed otherwise it continues to be an additional tax on the poor who have a high marginal propensity to consume because a large proportion of their incomes is spent on current consumption as opposed to the rich who have more income, but they spend less.