|

Getting your Trinity Audio player ready…

|

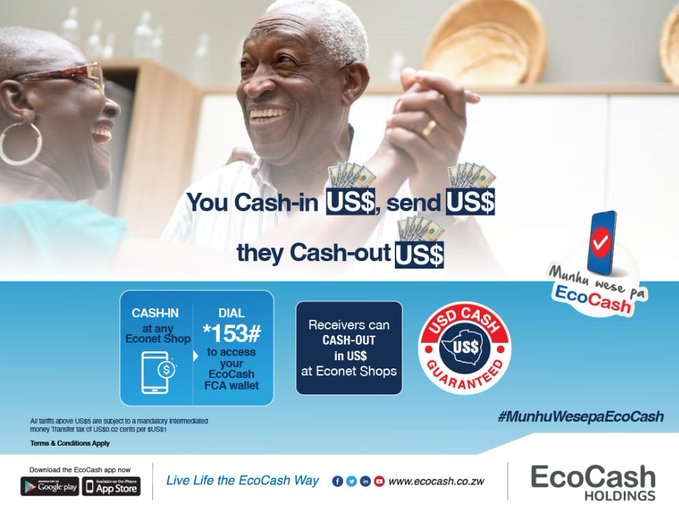

- Consumers can now send & receive US dollars on EcoCash

- Customers now able to buy USD airtime, pay for goods & services in USD using EcoCash

EcoCash, Zimbabwe’s largest mobile money platform, on Friday, launched a new service that will allow customers to cash in and cash-out United States dollars at Econet shops and Steward Bank branches across the country.

Speaking at the launch event in Harare, EcoCash Chief Operating Office Mr. Munyaradzi Nhamo said that EcoCash was delighted to offer customers the convenient option of sending and receiving US dollars across the country at any time and in real-time.

“It’s really about convenience,” said Mr. Nhamo, addressing guests at the function, who included senior representatives from the Reserve Bank of Zimbabwe (the mobile money platform’s primary regulator), EcoCash channel partners, merchants, banks as well as a diverse mix of EcoCash customers.

“To send US dollars, all that the customer needs to do is visit any Econet shop or Steward Bank branch countrywide and cash-in their US dollars into their EcoCash US dollar (FCA) wallet.

“Thereafter they can immediately transfer the funds to anyone – registered on EcoCash or unregistered – and the US dollars will land into the receiver’s wallet in real-time.

“The recipient can then go and cash out their US dollars, at their convenience,” said Mr. Nhamo.

He added that recipients can either cash out the US dollars as hard currency or use the US dollars directly from their US dollar wallet to transact electronically.

“Customers will be able to pay for goods and services electronically, be it in supermarkets or across any retail channels, pay their bills, or buy airtime – directly on their mobile phones,” Mr. Nhamo said.

Econet Wireless Zimbabwe, the largest mobile network operator in the country, recently introduced ‘Smart US dollar Bundles’ that allow customers to buy voice, SMS, and data bundles in US dollars. The new EcoCash service will give millions of Zimbabweans the option to conveniently buy airtime directly from their EcoCash US dollar wallet.

Mr. Nhamo said the new EcoCash US dollar service, which can be accessed on USSD code *153#, allows customers to transfer as little as US$1 up to as much as US$500 per day.

“Registered customers can also cash in or cash-out a maximum of US$2 000 per month, while unregistered users can transact up to US$250 per day and US$1 000 per month,” said Mr. Nhamo, adding that the statutory 2 percent intermediated money transfer tax applies to all transactions.

He also announced a US$10 000 promotion for early adopters of the new service.

“To kickstart this exciting service, we have set aside US$10 000 promotional funds to be won by our customers. For every US$1 you cash-in and send, we will give you back US$1. We offer cashback of up to US$10 per transaction, on a first-come-first-served basis,” Mr. Nhamo added.

Reserve Bank of Zimbabwe’s Director of Exchange Control, Mr. Farai Masendu, who was a guest of honour at the event, said the introduction of the Ecocash US dollar service was set to boost the flow of foreign currency through formal channels in the country.

“I would like to applaud EcoCash for launching another innovative product, which we believe will complement our efforts towards improving the country’s payment systems, ensuring the growth of mobile financial services in the country, and deepening of the country’s financial system,” he said.

Mr. Masendu noted that the new service was launched at an opportune time to facilitate the smooth flow of domestic remittances across the country, by breaching geographical boundaries and reaching out to all Zimbabweans.

“Given that mobile financial services are a key enabler of key economic activity, if we can spread this convenience to the most remote parts of our nation, our country will not only be able to see lives improve but this will also accelerate the mainstreaming of our people as economic players,” he said.

Mr. Masendu added that mobile money transactions now account for over ZW$66 billion per month, with EcoCash constituting close to 60% of that amount.

EcoCash Holdings Chief Executive Officer Mr. Eddie Chibi said the new service was expected to make life easier for millions of consumers struggling to safely send US dollars to their friends and family across the country.

“At EcoCash Holdings Zimbabwe Limited, our mantra is to solve people’s problems using innovation and technology,” he said.

“I am confident that the new service will bring convenience to millions of families, breadwinners, students, and communities across the country,” Mr. Chibi said, adding that the diversified conglomerate had responded to customers’ calls to be able to send and receive US dollars “using a trusted, reliable and secure platform”, the EcoCash platform.